- #Quicken mint personal capital blog review 2017 software

- #Quicken mint personal capital blog review 2017 free

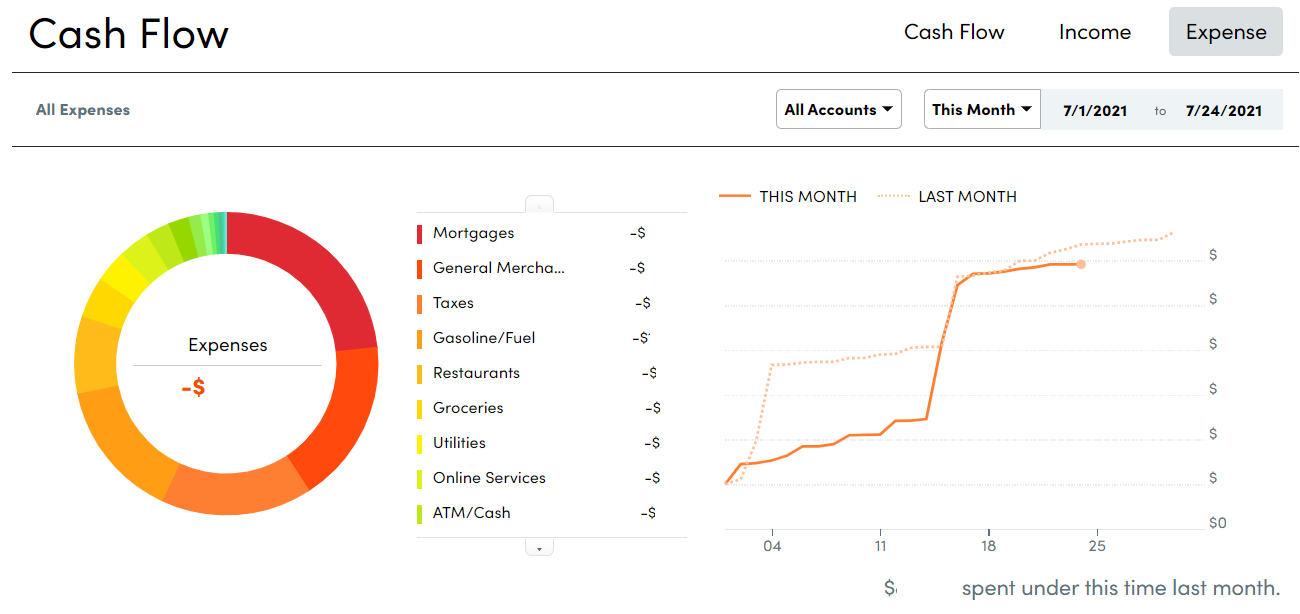

This will also help you to pay your bills on time and to track your spending. They provide a Cash Flow Analyzer tool that enables you to establish a budget by tracking both your income and expenses from all accounts and sources.

You do this by linking your various bank accounts and credit cards to the Personal Capital app. This can help you to know exactly where your money is going each month. It can also enable you to view and analyze the transactions in your budget, as well as to provide monthly summaries. For example, Personal Capital enables you to track your cash flow, as well as provide you with insights about your spending habits. Personal Capital does offer a budgeting function, but when compared that offered by Mint it’s extremely limited. Here are the services that Personal Capital provides: Budgeting & Cash Flow Management

#Quicken mint personal capital blog review 2017 free

So you can sign up for a free Personal Capital account and use their online suite of tools as long as you wish. There is no obligation to sign up for the Personal Capital Wealth Management service. Both versions offer you the various tools and features on the platform, but the premium version provides active investment management, similar to that offered by robo-advisors. They offer two services, the free version and a premium wealth management service. Over 1.4 million people use the service to track more than $350 billion in assets. – what are the similarities? What are the differences? Let’s compare the two.Īs noted above, Personal Capital is primarily an investment management service.

#Quicken mint personal capital blog review 2017 software

In my opinion, Quicken has been surpassed by these, and other, software apps. For example, while Personal Capital is primarily an investment management platform, is mostly a budgeting application.īecause these two programs offer a large number of robust features, I find them to be viable alternatives to Quicken, one of the original money management apps. But while there are overlapping similarities between the two, each has a different primary function. These two services are frequently compared.

They both offer a free service that offers users powerful money management or investment tools to help manage their spending, investing and more.

Personal Capital and Mint are two of the most prominent financial services platforms.

0 kommentar(er)

0 kommentar(er)